Harvard political economist explains eurozone crisis and roots of Euroscepticism

First in a series on what Weatherhead Center scholars think about the unfolding institutional, political, and economic consequences of the June 23 United Kingdom referendum on European Union membership.

After months of vitriolic campaigns, on June 23 voters began to emerge from polling stations throughout the United Kingdom having cast their ballots in a nationwide referendum on European Union (EU) membership. The possibility of a British exit, or “Brexit,” has shined a spotlight on the institutional, political, and economic woes of the EU and the eurozone. But for political economist Jeffry Frieden, Stanfield Professor of International Peace at Harvard University, this moment in British political life is merely the latest expression of domestic political unrest in a host of European countries.

Elections loom throughout Europe: in Spain three days after the UK referendum, in France and Germany next year. In a final irony, Britain is due to take the rotating presidency of the Council of the European Union in July 2017.

What does the future look like for a European Union tethered to a single market and a single currency? From the economic woes of the eurozone, to the political debates brought about by the refugee crisis, tension among EU member states has brought into question the very nature and future of European integration generally, and of monetary integration specifically.

Jeffry Frieden specializes in the politics of international monetary and financial relations. The Weatherhead Center for International Affairs sat down with its former interim faculty director to discuss the referendum and the eurozone crisis.

Q: You co-edited a recent special issue for Comparative Political Studies on the eurozone crisis, which you said has had a “massively negative” impact upon European attitudes toward national governments and EU institutions. Why?

A: Eurobarometer conducts very detailed surveys of European public opinion. And it might surprise you to know that Europeans, in general, still want the EU to succeed and move forward, and those in the eurozone still want the euro. What has changed is that people do not have any faith in their national governments or in the institutions of the European Union. So one way of interpreting this would be to say people like the idea of European integration, but they think that the politicians have completely screwed it up and they like the idea of the euro but they think the politicians have screwed that up, too.

And frankly, they're right. If you think that European integration is a good thing, you have to wonder why the European economy is doing worse today than it did during the Great Depression. European youth unemployment is 20 percent overall, and in some countries it’s above 40 percent. And this is eight to nine years after the crisis began. The survey questions in Eurobarometer that pick this up are questions like “How well do you think democracy is functioning in your country?” or “Do you trust your government?” What you find is that the level of trust both in national governments and in the European Union has collapsed. It's collapsed especially in the most crisis-ridden countries like Spain and Portugal. But it's also collapsed in northern Europe and Germany. It's collapsed more among poor people than among the upper classes.

Q: Why do you think the eurozone crisis is the most serious economic and political crisis in the history of the European Union?

A: Like the rest of the world, Europe faced a serious financial crisis starting at the end of 2007. In the United States, we dealt with the crisis, perhaps not as effectively as we might have, but within two years we were coming out of it. In the eurozone, on the other hand, the global financial crisis fed into a debt crisis that created enormous divisions—both among the member states of the European Union and within those member states. Those divisions have led to a gridlock in European politics and economic policy that makes American political gridlock look like child's play.

The eurozone debt crisis is a classic, standard-issue debt crisis. What happened in Europe—as has happened in debt crises for hundreds of years—was that banks made loans foolishly and borrowers borrowed money foolishly.

What typically happens in cases like this—as happened in the United States, as happened in the Latin American debt crisis of the 1980s, as happened in the East Asian crisis, as has happened in virtually every debt crisis in history—is that creditors and debtors sit down and over a long period of time and with great difficulty negotiate a way of trying to restructure the debts.

In the European case—with the sole exception of Greece, whose debt was so enormous that there was no chance they were going to be able to pay it back—there's been almost a complete political stalemate over any debt restructuring. That is, who's going to make the sacrifices necessary to deal with this outstanding debt? Creditor countries like Germany want to get paid back, and debtor countries like Spain want their debts to be favorably restructured. And so we've seen Europe divided between debtors and creditors, the Germans against the Spaniards, the Dutch against the Portuguese, and so on.

In the United States there was a borrowing boom and a housing bubble, which collapsed, and then we bailed out the banks. In Europe they had exactly the same thing: a borrowing boom, a housing bubble that collapsed, and then they bailed out the banks. However, people think Europe bailed out Greece, Spain, Ireland, and Portugal. In fact, the real purpose of the European bailout was not to backstop the Greek economy. The real purpose was to avoid a financial collapse in Europe.

Q: What do you think are some of the key misconceptions about the eurozone crisis?

A: The German public in particular is misinformed about the eurozone crisis. I hate to say it, but since the beginning the Merkel government has promoted a very moralistic view of the crisis, blaming the Greeks for taking advantage of hardworking Germans. The misconception is that the governments of the debtor countries borrowed excessively. That’s not true. Only in Greece was there substantial government borrowing. In Spain and Ireland, all of the borrowing was private-to-private. That is, private German or Dutch or French banks lent money to private Spanish banks or private homeowners in Ireland. In other words, it was a completely market-based operation at the outset. Eventually it became a government debt issue when Spain and Ireland took over the bad debts the private banks had incurred.

The second misconception was that the eurozone crisis was simply the result of irresponsible borrowing. In my view, if the money was borrowed irresponsibly, it was also lent irresponsibly. The German banks made incredibly stupid mistakes. The German financial system is a total mess—they already had one series of bank failures in the early 2000s. Deutsche Bank is currently effectively bankrupt, and it's only standing because the German government is keeping it on its feet. Germans don't understand this. The Germans think that their bankers are fine upstanding citizens who make correct decisions, and the reality is that the German banks were among the worst offenders in the run-up to this debt crisis. When debts go bad, it's the fault of both the debtor and the creditor.

Q: The economic reasons for the eurozone crisis are fairly clear to specialists in international macroeconomics and finance. But what are some of the key political factors?

A: Yes, economists have a long-established way of thinking about the prospects for currency unions—the theory of optimum currency areas. Right from the beginning, this theory suggested serious concerns about the euro. But I agree with you, what is a little less clear to the general public is some of the political underpinnings of those economic problems. In the case of the eurozone, the politics have to do with the way it was constructed.

Instead of having different policies for a stagnant economy and for a rapidly growing economy, the eurozone has a one-size-fits-all monetary policy. And that exacerbated some of the problems. It encouraged capital to flow from the stagnant countries to the rapidly growing countries, which contributed to the borrowing expansion and eventually the boom.

A second problem was that almost immediately after the eurozone was set up, the financial markets of all of the member states were effectively integrated. Money began to flow freely among the eurozone countries, but each country had its own very different financial regulations. And banks took advantage of these regulatory differences by trying to evade strict regulations in favor of looser regulatory environments. This banking behavior happens everywhere, but in the eurozone it was a particularly difficult problem.

The third big political problem was that there was a perception on the part of the markets that if one country in the eurozone got in trouble it would get bailed out.

Q: What is the “no bailout” commitment, and why is it a problem?

A: It’s the commitment on the part of the member states not to bail out a country that gets into financial trouble.

Let's take an example. If you lend money to a very sketchy borrower, you expect to get a higher interest rate. But if you believe this very sketchy borrower will get bailed out by his father, say, then you think, “OK, I'll lend it at the interest rate I charge his father.” In Europe, banks lent money to Greece and Portugal without charging them substantially higher interest rates because they believed Germany would bail them out. Why? Because a financial crisis in one part of the eurozone would become a financial crisis in the entire eurozone. This was widely predicted: that unless there was what political economists call a “credible no bailout commitment,” there would be economic fallout.

That commitment was not credible. No one believed it. As it turned out, they were right not to believe it, because when the crisis happened the Germans and the Dutch and everybody else did in fact step in to bail out their own banks. And this is something that people are very confused about. The money that was thrown into the eurozone debt crisis did not go to bail out Greece. It went to bail out the German and other northern European banks.

Q: Some economists insist the British pound would probably be the biggest casualty of a Brexit vote. Does your research on currencies echo this concern?

A: I think the initial reaction would almost certainly be negative. If the British begin the process of exiting the European Union, it’s unclear exactly what that would look like and what the ultimate effects would be. And that uncertainty is likely to drive down the British pound in the short term. In the long run, how the British economy does depends on how Brexit is managed and what the new relationship between the United Kingdom and the European Union entails. Will the UK be able to carve out trade deals for itself, and how soon? Will they be considered like Norway, which is given basically free access to the European Union? The second uncertainty that is very important to the British pound is finance. London today is Europe's financial center. If the UK were not in the EU, banking regulations and the way that that money is moved throughout the European Union becomes more complicated.

Q: What are some examples of the political costs the eurozone crisis generated for some of its member-state governments?

A: Domestically, the implementation of austerity measures and structural reforms proved difficult and politically costly. One government after the other fell, radical populist parties were strengthened, and general satisfaction among citizens with the EU reached unprecedented lows. One of the reasons for the rise of both right wing and left wing populist movements in Europe is the loss of faith in the traditional established political parties and political institutions. People are voting for extremist parties not because they've suddenly turned far to the right or far to the left—their ideological views haven't changed much. But, they're just fed up with the existing political elites.

The recent global financial crisis is unusual for being the first massive debt crisis in a series of developed countries. There have been debt crises in developed countries before—Germany in the 1930s for example. But to have debt crises in the US, the UK, Spain, Greece, Ireland, all at the same time is really unprecedented.

—Amanda Pearson (@Pearson_ink), Communications Specialist, Weatherhead Center for International Affairs

Jeffry A. Frieden is the Stanfield Professor of International Peace at Harvard University and a Faculty Associate at the Weatherhead Center for International Affairs. For more information about the eurozone crisis, read his paper with co-authors Mark Copelovitch and Stefanie Walter titled “The Political Economy of the Euro Crisis.”

Copelovitch, Mark, Jeffry Frieden, and Stefanie Walter. “The Political Economy of the Euro Crisis.” Comparative Political Studies vol. 49, no. 7 (2016): 811–840. doi: 10.1177/0010414016633227.

Captions

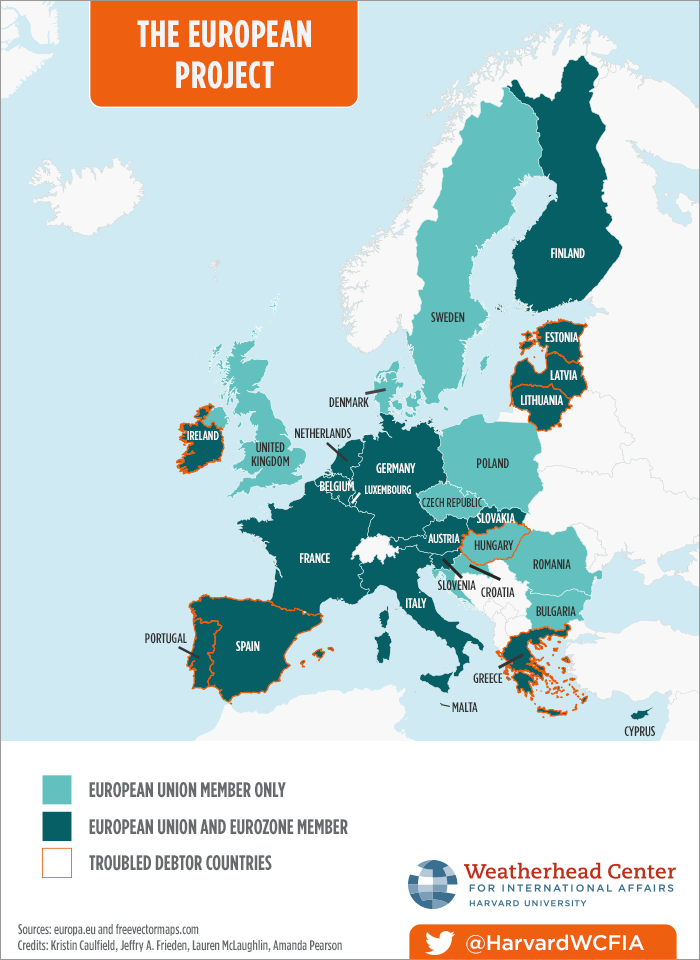

- The European Project Map: There are twenty-eight member states in the European Union, nineteen of which are also in the eurozone. Eight countries, primarily both EU and eurozone members, comprise the most troubled debtors.

- European Integration Timeline: Many historical events paved the way for the creation of the EU and eurozone. The move toward European integration involves decades of treaties and collaboration, resulting in apparent success by 2008—right around the time the US financial crisis triggered a global financial crisis that impacted Europe.

- European Crisis Timeline: Once the eurozone crisis began in 2009, many of the troubled debtor countries requested and received financial assistance packages. It would be several years before the greater European economy would recover.

Also in the series: Background to Brexit: How to Leave the EU.